|

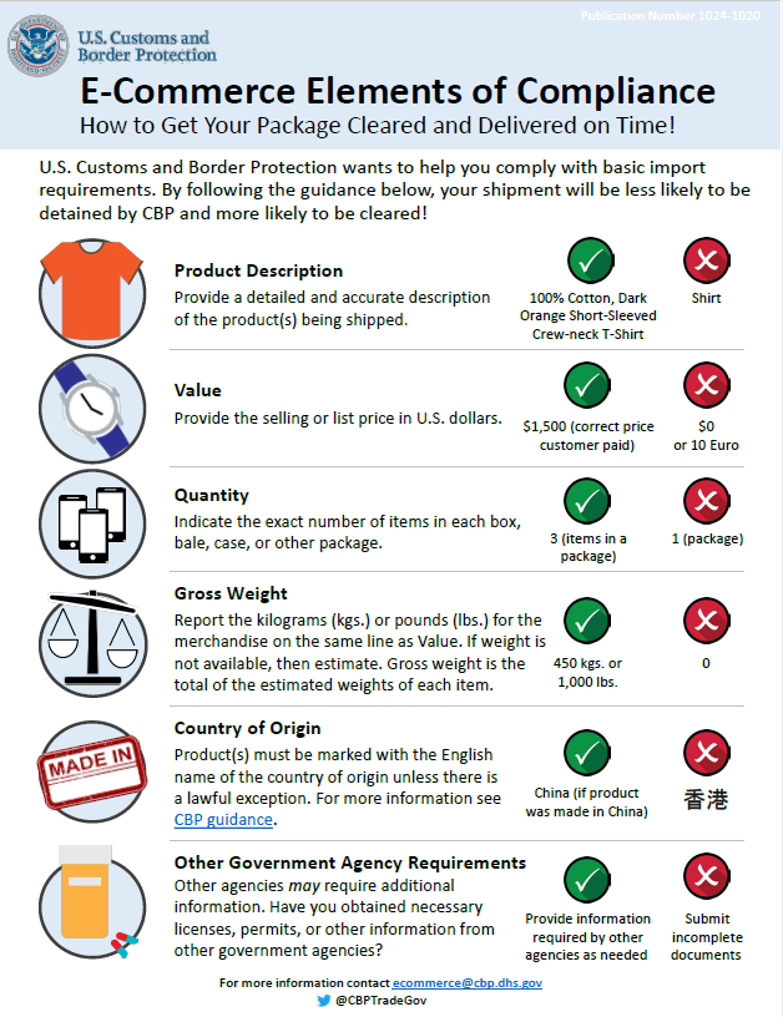

Why is Electronic Commerce (E-Commerce) important for importers/exporters? The Internet provides a direct and a more transparent channel for both buyers and sellers to conduct business via e-commerce platforms. E-commerce has enabled small and medium-sized enterprises (SMEs) to reach customers in domestic markets as well as overseas. According to the McKinsey Global Institute, an estimated 12% of global trade in physical merchandises ($2.3 trillion in 2018) -- including business-to-business (B2B) and business-to-consumer (B2C) channels -- is conducted via e-commerce, with around $700 billion being cross-border purchases[1]. In 2018, 1.8 billion people around the world purchased goods online, and 57% of these online buyers purchased goods from sellers abroad, according to the US Congressional Research Service[2]. With the growing use of e-commerce platforms, doing business online has become an equally critical channel for importers and exporters to establish relationships and supply chains as traditional brick-and-mortar outlets. Barriers to Cross-Border E-Commerce Given the growing scale of e-commerce around the world, countries have faced various concerns in regulating cross-border e-commerce activities, such as trade barriers, data privacy, and others. Depending on the country, barriers to e-commerce include possible customs duties, low de minimis value on physical merchandise, and data localization in e-payments[1]. To address these issues, 75 nations have agreed to participate in plurilateral negotiations at the World Trade Organization (WTO), following the 2017 joint statement at the Buenos Aires Ministerial Conference[2]. Since 2017, e-commerce negotiations have been under “fast track” and countries are working toward a draft text of an agreement[3]. Below are a few examples of trade barriers in cross-border e-commerce: 1. Customs Duties on Digital Goods and Services Since May 1998, WTO members have issued several extensions on temporary prohibition of customs duties charged on electronic transmissions or digital goods, such as e-books or music[4]. However, it is not clear if the negotiations at the WTO moving forward would also continue to prohibit customs duties on digital goods and services. Currently, without a specific trade agreement to reflect on the digital economy at the global level, the United States has included e-commerce chapters in recent bilateral free trade agreements, and has continued to exclude customs duties on electronic transmissions in more recent agreements with Singapore and Korea[5]. Without the benefit of exempting online transactions from customs duties, the costs related to e-commerce purchases may increase for both buyers and sellers. 2. Low De-Minimis Value De minimis value thresholds to waive customs duties (and/or regulatory requirements) for small shipments can vary significantly by country. Shipments with a value above a country’s de minimis threshold are subject to customs duties. A low de-minimis value can lead to higher tariff costs and require more resources by Customs authorities to manage. For instance, the de minimis value in the US is currently $800, meanwhile it is extremely low in Canada ($15) and Mexico ($50) [6]. For a shipment valued at $500 entering the US, no duty is applied. However, given the low de minimis value, the same shipment with the same value entering Canada or Mexico would be subject to customs duties. Due to a lack of a universal rule on de minimis value, importers and exporters conducting e-commerce often absorb these trade costs on their own, and thereby transfer the costs to end consumers. Under the US-Mexico-Canada Trade Agreement (USMCA), Canada and Mexico have agreed to increase their duty-free de minimis values to $117, which are steps in the right direction, but are not on par with the United States[7]. Unfortunately, the US also included a provision that could lower its de minimis value to the same level as Canada and Mexico[8]. US SMEs have noted this would create more problems than it solves given unpredictability and more costs on US importers. 3. E-Payments There are no standard regulations on electronic payment services supporting cross-border online transactions around the world, which have limited many e-commerce sellers’ and buyers’ ability to conduct cross-border transactions. Some regulations prevent buyers from completing online transactions when they occur overseas. This kind of restriction can limit e-commerce transactions that depend on foreign financial service providers[9], such as Paypal, Square, local credit cards, or other local online banking services. For instance, if a buyer attempts to use a credit card from a local bank that does not provide services in the seller’s country, such cross-border online transaction may not be processed, due to data localization restrictions. While no existing international agreements address this issue, countries have begun including modernized measures in recent regional or bilateral trade agreements. For example, under the Financial Services chapter in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), commitments allowing the cross-border supply of electronic payment services for payment card transactions are included[10]. Online transactions supported by foreign financial services are permitted to take place without having to establish infrastructure in-country. With this inclusion, cross-border e-commerce in the region is expected to grow more rapidly. In addition, the proliferation of e-commerce transactions for goods have put additional strains on Customs authorities and regulatory agencies to ensure legitimate trade and safety for consumers in their markets. Customs authorities, like US Customs and Border Protection (CBP), are working to balance trade facilitation with air transport and supply chain security resulting from millions of e-commerce packages arriving at their borders. For instance, CBP published resources to help inform e-commerce compliance at the border, such as the example below. For more detail, visit www.cbp.gov/trade/basic-import-export/e-commerce. While e-commerce continues to surge, trade barriers are likely to continue to impede e-commerce growth of global trade in physical goods, as well as in digital goods and services. In short, as countries continue to develop their economies and technology, the world trading system will need to address these new policy issues in the digital era. Establishing an international agreement in e-commerce is an important step to level the playing field, help ensure safety and transparency of online transactions, provide structure to balance supply chain security issues with trade facilitation, and further reduce additional trade barriers.

We would love to hear from you. Send us your thoughts or your experience in e-commerce on our LinkedIn or Twitter. Chinyen Cheng [email protected] (+1) 240.389.9003 [1] Dozens of countries are in talks to regulate cross-border e-commerce, McKinsey Global Institute, 5 March 2019 [2] International Trade and E-Commerce, Congressional Research Service, 1 May 2019. Page 1. [3] Ibid. Page 2. [4] Electronic Commerce - Brief, World Trade Organization [5] WTO e-commerce still on ‘fast track,’ but outcomes not expected by ministerial, Inside Trade, 11 October 2019. [6] Digital Trade and U.S. Trade Policy, Congressional Research Service, 21 May 2019. [7] Ibid. Page 39-40. [8] International Trade and E-Commerce, Congressional Research Service, 1 May 2019. Page 2. [9] Higher De Minimis Thresholds: A Win in the USMCA, Peterson Institute for International Economics, 15 October 2019. [10] How a Footnote in the USMCA Undermines Economic Liberty, CATO Institute, 30 August 2019. [11] International Trade and E-Commerce, Congressional Research Service, 1 May 2019. Page 1-2. [12] Addressing E-Payment Challenges in Global E-Commerce, World Economic Forum, May 2018. Page 11. 8/9/2021 03:13:05 am

I am glad to see that important information. Thank you very much to share with us. Comments are closed.

|

|